Probate is the process by which the Probate Court handles a deceased person's estate if there is no trust (of if there is a trust, but it wasn't properly funded); it applies if there is a will only, or if there is no will. Essentially, a probate petition is filed with the Court, creditors are notified, the personal representative lists all of the estates assets and liabilities, a probate referee appraises the non-cash assets, any disputes relating to the estate are settled, a final accounting is made, the creditors are paid and then the remainder is paid to the beneficiaries.

The Basics

Essentially, a probate petition is filed with the Court, creditors are notified, the personal representative lists all of the estates assets and liabilities, a probate referee appraises the non-cash assets, any disputes relating to the estate are settled, a final accounting is made, the creditors are paid and then the remainder is paid to the beneficiaries.

Timing

Probate often takes 8 to 10 months, although it can take even longer. During that time, if the family needs money from the estate, a motion has to be brought and a court order obtained.

Terminology

The person handling the estate is called the "Executor" if there is a will or the "Administrator" if there is no will or no executor is named in the will. "Personal Representative" refers to either an executor or an administrator.

Exceptions to Probate

- Trusts

No probate is required if the estate is owned by a properly funded trust. However, if the assets titled in the name of the decedent alone (i.e. outside the decedent's trust) are worth $150,000 or less (excluding non-probate assets, discussed below), then probate may still be needed.

- Where All Property Goes to the Spouse

If there is no trust covering the property, then it may be possible to file only a spousal petition (versus going through a full-blown probate) if the surviving spouse has 100% unqualified ownership of property (meaning there are no co-owners, it is not merely a life-estate, etc.). Usually this requires either a will giving 100% of the property to the surviving spouse and/or proof that all of the property owned by decedent was community property.

- Estates Worth $150,000 or Less

- If the gross value of the estate is $150,000 or less (without subtracting any liens, debts, deeds of trust, etc.), there are simple procedures for distributing an estate without using formal probate proceedings. Certain items are excluded from the calculation of the $150,000. Some of these are:

- Joint tenancy property (real or personal);

- Community property with right of survivorship;

- Life insurance and death benefits (assuming that beneficiaries are named);

- Multiple party accounts.

- Pay on death accounts (assuming that beneficiaries are named).

- Retirement accounts (assuming that beneficiaries are named).

Estates with No Will

Where the decedent died intestate (without a will), California law determines how the estate will be distributed.

Attorney and Executor Fees

- Attorneys' fees for handling a probate are set by California statute and are based on the gross estate, meaning that there is no subtraction for any liens, debts, deeds of trust, etc.

- If extraordinary services are required, the attorney may be able to recover additional amounts.

- The Executor of a will is also entitled to the same amount of statutory fees unless the will does not allow them, although the Executor can waive those fees if he/she wishes (and family members often do).

Bonds

- Generally, unless there is a will that designates an executor and waives the bond, the personal representative must post a bond to guarantee that he/she will fulfill his/her duties.

- If the person is out of state, the Court will generally require a bond even if the will waives it.

- Even if the will does not waive the bond, the bond usually can be waived by all interested parties.

Inventory and Appraisal

After being appointed, one of the first things that the personal representative does is file with the Court an inventory of all the assets of the estate that are covered by the probate. Assets that are not subject to probate (for example, joint-tenancy property with right of survivorship) are not listed.

- Generally at the beginning of the probate, a probate referee is also appointed to make an appraisal of the non-cash estate assets. While it is possible to seek a waiver from the Court of the appraisal by the probate referee, good cause must be shown.

- Basically, the probate referee is compensated by a commission of one-tenth of one percent of the total value of the assets appraised.

Notifying Creditors and Dealing with Creditor Claims

- Newspaper Publication of the Petition for Probate

The notice of the petition to administer the estate must be published in a newspaper. Proof of the publication must be filed with the Court before the hearing on the petition for probate is held.

- Notice to Specific Creditors

The personal representative must give notice directly to reasonably ascertainable creditors before the later of (a) four months after the date of issuance of the "letters" appointing the representative or (b) 30 days after the personal representative first becomes aware of the creditor. Proof of the notice to each creditor must be filed with the Court.

- Time Limits for Creditors to File Claims

Each creditor must file a claim. The general rule is that a creditor's claim is barred if it is not filed by the later of (a) four months after issuance of the "letters" appointing the personal representative or (b) 60 days after the date that specific notice is given to that creditor.

Account, Report and Petition for Distribution

The personal representative must file the final accounting (unless waived), a report and a petition for distribution, the time for filing creditors' claims has expired, and the estate is ready to be closed.

To learn more, please Contact Me

Disclaimer

"Administration" or "settlement" of a trust after a death is a sobering responsibility. The trustee should be represented by legal counsel. There are many legal, tax, accounting, and investment obligations/duties of a trustee, some of which impose personal liability on the trustee(s). What follows is a general summary of concerns and requirements. It is not all-inclusive. Our firm is experienced and committed to assist the trustee in every step of the process.

Administration of Trust Assets

Where there is a trust and a creator of the trust dies:

- A cotrustee may have to continue on as the sole trustee and administer the trust; or

- A nominated successor trustee or trustees will have to administer the trust.

In many cases, the creators of the trust are husband and wife. When either spouse dies, the surviving spouse is usually a beneficiary and a cotrustee. Depending on the type of trust involved:

- There may be only one trust after the first death. This trust may be under the complete control of the surviving spouse; or

- There may be two or more sub-trusts created after the first death, some revocable and some irrevocable.

Immediate Duties of the Trustee

The trustee, even a surviving spouse, has duties. Depending on the type of trust and the size and type of assets, the trustee usually must immediately:

- Obtain any required taxpayer identification numbers from the I.R.S.;

- Notify Social Security and, if a surviving spouse, also apply for the lump sum death benefit;

- Where appropriate, forward the mail;

- Notify VA, if deceased was a veteran;

- Notify Pension Plan Administrator to obtain: (1) designated beneficiaries; (2) elections available and deadlines; (3) description and amount of benefits; and (4) procedures and time limits for benefits.

Additional Duties of the Trustee

In addition, the trustee has responsibility to do the following:

- Immediately read and interpret the trust and related documents; ask the lawyer for guidance

- Follow the terms of the trust and related documents;

- Locate and inventory all assets owned by the deceased person's trust. If the trustee is also the executor of the deceased person's last will, this extends to all assets, if any, that may have been owned by the deceased person in his or her name outside of the trust;

- Within 6 months, value all assets inventoried as of the date of death; most of the time, appraisals are needed and the Trustee should obtain professional appraisals by qualified appraisers for difficult to value assets.

- Within 6 months, determine the value of decedent's gross estate; "Gross estate" is a technical federal tax term that may include assets previously transferred. If the value of the Gross Estate

exceeds" the federal exemption amount, serious reporting responsibilities with deadlines are triggered.

- Safeguard all assets. If there are non-cash assets such as personal property, real property, vehicles, etc., the trustee must take appropriate action. For example, real property and vehicles must have insurance. Property taxes and loans must be paid. Security, maintenance, and related issues must be addressed. If the property is a rental, perhaps a property manager must be retained;

- Timely provide legally required notices. For example:

- Make sure all creditors (known or suspected) are notified (in writing) of the death and make arrangements to evaluate the claims;

- Notify the state's health department in writing;

- Most states require that the Trustee provide required formal notice to all beneficiaries of the trust (as well as all heirs at law);

- Comply with applicable Trust Code or state law disclosure for trust beneficiaries

- Arrange to have tax returns filed. For example, the deceased person's final income tax return, as well as any gift, estate tax, or other return, may be required;

- Obtain any required taxpayer identification numbers from the I.R.S.;

- Properly deduct costs of funeral, final illness, taxes, other bills, and cost of administration (including trustee fee, attorney fee, and accountant fee);

- Refrain from commingling the trust assets with your personal assets (or those of anyone else). The assets should be transferred to a separate trust account, which should be insured and interest-bearing. All trust business should be conducted from this account. The trustee may very well be required to provide a detailed account of tenure as trustee, so keep records of everything;

- When the administration is concluded, deduct all costs of administration (for example, trustee, legal, accounting, and appraisal fees, taxes, etc.) and distribute the net remaining balance to the appropriate beneficiaries;

- Clear title to remove the name of the deceased trust creator/trustee from:

- Real properties;

- Financial, investment, and other accounts

- Create any required sub-trusts;

- Allocate and transfer assets to appropriate sub-trusts;

- Prepare the accounting;

- Determine net remaining balance to be distributed; and

- Upon distribution to beneficiaries, prepare needed receipts. Beneficiaries will have to decide either to waive a formal account or to require a formal account.

Summary

We guide and assist the trustee through the maze of legal, accounting, tax and ethical issues required to administer and distribute the estate of a deceased person. The most important point you should get from this website is that you should seek appropriate professional assistance!

To learn more, please Contact Me

Disclaimer

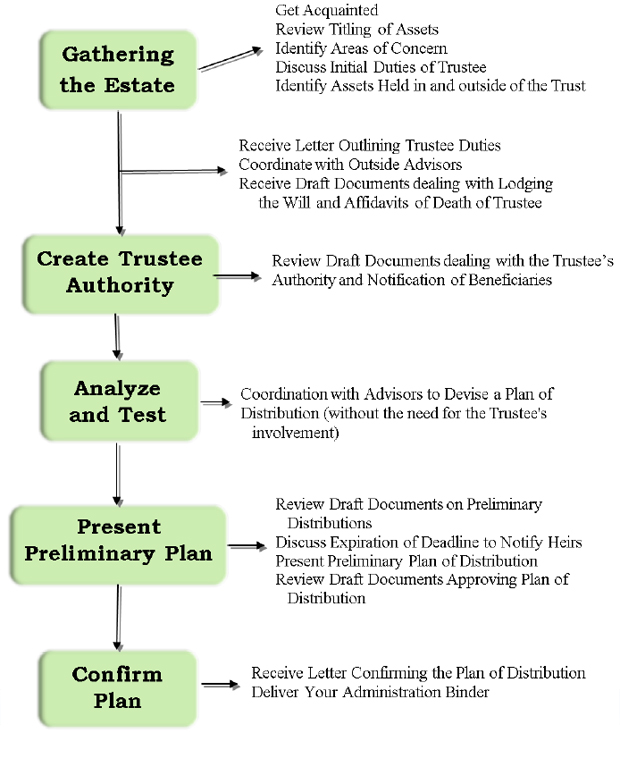

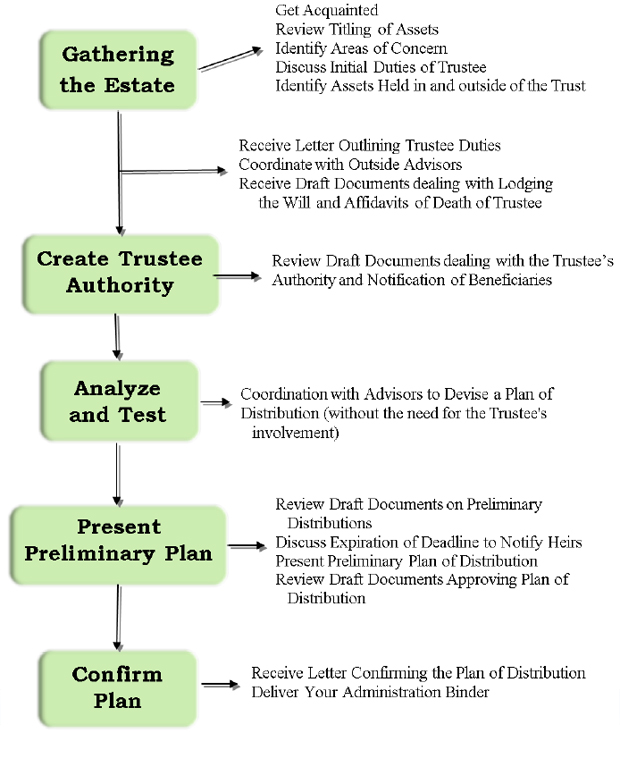

To assist you through the maze of the administrative process, we have created the below flow chart:

To learn more, please Contact Me

Disclaimer

DECEDENT'S ESTATE ORGANIZER

Rowe Mullen LLP

Estate and Trust Planning

The information in this organizer is critical for the settling the decedent's estate in accordance with decedent's wishes and applicable law. All information you give us will be held in strict confidence. If possible, please bring to our office for your appointment:

This Organizer is to be Completed by You.

Please gather the documents listed on the Document Checklist to bring to the "Gathering the Estate" Meeting.